Letter School handwriting apk alphabet backwards 3X Speed lowercase letters Trace Practices z to a

Stunning Cozy Deluxe Ozark Log Cabin 6 Sleeps with Full Bath and Kitchen

-------------------------------------------

Honda Civic | FD2 TypeR Body Kit // Modification (Facelift) # Part1 - Duration: 9:02. For more infomation >> Honda Civic | FD2 TypeR Body Kit // Modification (Facelift) # Part1 - Duration: 9:02.

For more infomation >> Honda Civic | FD2 TypeR Body Kit // Modification (Facelift) # Part1 - Duration: 9:02. -------------------------------------------

Steuererklärung Rentner Muster | Elster Tutorial | Steuererklärung selber machen - Duration: 21:33. For more infomation >> Steuererklärung Rentner Muster | Elster Tutorial | Steuererklärung selber machen - Duration: 21:33.

For more infomation >> Steuererklärung Rentner Muster | Elster Tutorial | Steuererklärung selber machen - Duration: 21:33. -------------------------------------------

Make your own moves. For more infomation >> Make your own moves.

For more infomation >> Make your own moves.-------------------------------------------

Al Bano e Romina Power insieme per Capodanno: ecco il loro regalo per i fans | K.N.B.T - Duration: 3:56. For more infomation >> Al Bano e Romina Power insieme per Capodanno: ecco il loro regalo per i fans | K.N.B.T - Duration: 3:56.

For more infomation >> Al Bano e Romina Power insieme per Capodanno: ecco il loro regalo per i fans | K.N.B.T - Duration: 3:56. -------------------------------------------

Patè di olive nere bimby per TM5 e TM31 - Duration: 3:05. For more infomation >> Patè di olive nere bimby per TM5 e TM31 - Duration: 3:05.

For more infomation >> Patè di olive nere bimby per TM5 e TM31 - Duration: 3:05. -------------------------------------------

A cosa servono il Gel e la Schiuma da Barba? Prodotti per la Rasatura Gillette - Duration: 2:00. For more infomation >> A cosa servono il Gel e la Schiuma da Barba? Prodotti per la Rasatura Gillette - Duration: 2:00.

For more infomation >> A cosa servono il Gel e la Schiuma da Barba? Prodotti per la Rasatura Gillette - Duration: 2:00. -------------------------------------------

"Uomini e donne", al trono over è ora di cambiare. Maria De Filippi e Tina silurano Gemma | M.C.G.S - Duration: 8:23. For more infomation >> "Uomini e donne", al trono over è ora di cambiare. Maria De Filippi e Tina silurano Gemma | M.C.G.S - Duration: 8:23.

For more infomation >> "Uomini e donne", al trono over è ora di cambiare. Maria De Filippi e Tina silurano Gemma | M.C.G.S - Duration: 8:23. -------------------------------------------

Andrea e Giulia in crisi? La clamorosa indiscrezione dopo il GF Vip | Wind Zuiden - Duration: 3:33. For more infomation >> Andrea e Giulia in crisi? La clamorosa indiscrezione dopo il GF Vip | Wind Zuiden - Duration: 3:33.

For more infomation >> Andrea e Giulia in crisi? La clamorosa indiscrezione dopo il GF Vip | Wind Zuiden - Duration: 3:33. -------------------------------------------

Barriers and challenges to the study of science and religion in Latin America - Ignacio Silva PhD - Duration: 6:03. For more infomation >> Barriers and challenges to the study of science and religion in Latin America - Ignacio Silva PhD - Duration: 6:03.

For more infomation >> Barriers and challenges to the study of science and religion in Latin America - Ignacio Silva PhD - Duration: 6:03. -------------------------------------------

'...범.죄 알림e'에 신상정보가 나오는 연예인이 있다 - Duration: 2:30. For more infomation >> '...범.죄 알림e'에 신상정보가 나오는 연예인이 있다 - Duration: 2:30.

For more infomation >> '...범.죄 알림e'에 신상정보가 나오는 연예인이 있다 - Duration: 2:30. -------------------------------------------

BEBA ISTO PARA EMAGRECER SECAR A BARRIGA E DIMINUIR O COLESTEROL - Duration: 3:47. For more infomation >> BEBA ISTO PARA EMAGRECER SECAR A BARRIGA E DIMINUIR O COLESTEROL - Duration: 3:47.

For more infomation >> BEBA ISTO PARA EMAGRECER SECAR A BARRIGA E DIMINUIR O COLESTEROL - Duration: 3:47. -------------------------------------------

FAZENDO LISTA DE RESOLUÇÕES PARA O ANO NOVO - Duration: 2:10. For more infomation >> FAZENDO LISTA DE RESOLUÇÕES PARA O ANO NOVO - Duration: 2:10.

For more infomation >> FAZENDO LISTA DE RESOLUÇÕES PARA O ANO NOVO - Duration: 2:10. -------------------------------------------

380257 - Duration: 6:35. For more infomation >> 380257 - Duration: 6:35.

For more infomation >> 380257 - Duration: 6:35. -------------------------------------------

Mercedes-Benz E-Klasse 240 Avantgarde Automaat,Navigatie,Xenon - Duration: 0:54. For more infomation >> Mercedes-Benz E-Klasse 240 Avantgarde Automaat,Navigatie,Xenon - Duration: 0:54.

For more infomation >> Mercedes-Benz E-Klasse 240 Avantgarde Automaat,Navigatie,Xenon - Duration: 0:54. -------------------------------------------

PEMBANTU CANTIK NGEVLOG GINI JADINYA!! - Duration: 6:41. For more infomation >> PEMBANTU CANTIK NGEVLOG GINI JADINYA!! - Duration: 6:41.

For more infomation >> PEMBANTU CANTIK NGEVLOG GINI JADINYA!! - Duration: 6:41. -------------------------------------------

7.07D New Dota 2 Tips, Tricks and Bugs! - Duration: 5:18. For more infomation >> 7.07D New Dota 2 Tips, Tricks and Bugs! - Duration: 5:18.

For more infomation >> 7.07D New Dota 2 Tips, Tricks and Bugs! - Duration: 5:18. -------------------------------------------

COMO FAZER MANDALA USANDO UM PRATO QUEBRADO - Artesanato - Prato decorado + RECEBIDOS - Duration: 10:40. For more infomation >> COMO FAZER MANDALA USANDO UM PRATO QUEBRADO - Artesanato - Prato decorado + RECEBIDOS - Duration: 10:40.

For more infomation >> COMO FAZER MANDALA USANDO UM PRATO QUEBRADO - Artesanato - Prato decorado + RECEBIDOS - Duration: 10:40. -------------------------------------------

Anticipazioni Le tre rose di Eva 4 ultima puntata: il finale shock | Wind Zuiden - Duration: 3:40. For more infomation >> Anticipazioni Le tre rose di Eva 4 ultima puntata: il finale shock | Wind Zuiden - Duration: 3:40.

For more infomation >> Anticipazioni Le tre rose di Eva 4 ultima puntata: il finale shock | Wind Zuiden - Duration: 3:40. -------------------------------------------

The best bodies that bared it all in 2017 - Duration: 2:52.

The best bodies that bared it all in 2017

These ladies could cover it up, but why would they?. Brazilian babes get cheeky for Miss Bumbum contest.

A parade of butts flocked to Sao Paulo, Brazil, to compete for the title of Miss Bumbum. The annual butt contest is looking for Brazil's best butt, which has to be all natural. This woman is one unlikely Mormon.

Allegra Cole grew up in the Mormon faith, but now the 47-year-old beauty has a new passion: showing the world her gargantuan breasts.

The glamour model earns up to $100,000 a year, and has undergone three boob jobs, a tummy tuck and a butt lift to get her desired physique. "I want to be the 21st-century poster woman for carrying big breasts," she said.

This curvaceous hottie has some steamy pole dancing moves. Ro'Yale may be bigger than your typical pole dancer, but Da Queen of Curves, as she's known around the dance studio, has the sex appeal to match.

After turning 30 and temporarily separating from her husband,Ro'Yale took a pole dancing class that ended up changing her life. Now she teaches a pole class for plus-sized women. Male model transitions into a Barbie doll.

Eden Estrada was once a male high-fashion model, but after transitioning a year ago, she's now known on social media as Eden the Doll. "I'm not just transgender," the buxom Los Angeles native said. "I'm a normal 21-year-old woman.".

Sexy cam girls help you get over the hump of learning a language. If you're hot for teacher, these online linguistics courses may be for you. Webcam models are now teaching language lessons on the porn platform CamSoda.

The private tutorials cover basic vocabulary as well as sensual conversation. According to Daryn Parker, vice president of the company, "breasts, butts, and vaginas" are included.

-------------------------------------------

2017 Highlights - The Planetary Post with Robert Picardo - Duration: 4:19.

This is Robert Picardo and you're watching The Planetary Post.

Because I'm uniquely qualified

Hi space fans. A lot happened in 2017. Here's a montage of

some of our favorite moments on the Planetary Post.

We're here at the March for Science in Washington DC. There are thousands and thousands and

thousands of people here and one crappy poster that I made.

Let's hear it for Science! We're about to march!

It's wonderful to be in the middle of all this excitement. Americans who care about science.

Oh my god, it's Tim Russ my buddy from Star Trek. Good to see ya.

-Nice to meet you. I was just-- -Tim it's me. It's Bob Picardo.

-Bob Picardo? -Star Trek. Voyager.

-Here is a picture of the Star Trek Voyager cast. -Oh yes, the the bald guy that was in there.

Do you carry this around everywhere you go?

(Laughing)

That great big white thing up there, Bob, is the moon.

It looks a little bit like my complexion when I was 15.

I'd like to thank our guest this month on the Planetary Post, my friend Dr. Amy Mainzer.

-Oh thank you so much. -And I'd like to present you with this souvenir asteroid

Wow thanks Bob cheapest sample return ever!

That was so cute. That was hilarious.

I'm here with a throng of people waiting to get in to see Bill Nye: Science Guy the movie.

Let's just chat with one of them.

Sir, are you here to see the film tonight?

Yeah, my girlfriend wants to see it.

Do you have any expectations for how it might be.

Well, I think it's going to be less than two hours.

I love those little cartoon dinosaurs.

To much Romulan wine, I think.

Should I do Romulan? Do you like Romulan wine better or Klingon a blood wine?

Too much Kling- (laughter)

Bwahaha! It's Halloween on the Planetary Post and I am the Phantom of the Orbit.

-Dr. Batygin thanks for joining us today. -It's my pleasure to be

here but I'll have you know that today I am Count Konstantinovich from Planet 9.

I have a costume just like this. Did you give him my costume?

He gave you my costume.

Wow he turned into a bat and flew away.

(Laughter)

-Ready? I put my foot on the mark. -Start the song. -Here we go.

(Wrong song plays)

Goodbye Cassini. Your mission's fini.

Bravo Cassini. Have some linguini.

Can you explain then how we get this big shade all bunched up so

that we can launch it in space?

We use the power of origami to fold up these

incredibly large spacecraft into small spaces so we can fit them inside a

rocket as a challenge , would you like to try folding up the star shade?

Oh, I dropped it here. Oh! I guess I was done.

Now dive to Saturn vaporize!

Bravo! Bravo! Magnifico, magnifico. Bravo!

Picardo! Picardo!

you

-------------------------------------------

18th Birthday Debut Party - Untertitel auf Lingala l TRISCCHA - Duration: 10:21. For more infomation >> 18th Birthday Debut Party - Untertitel auf Lingala l TRISCCHA - Duration: 10:21.

For more infomation >> 18th Birthday Debut Party - Untertitel auf Lingala l TRISCCHA - Duration: 10:21. -------------------------------------------

Las Noticias de la mañana, Viernes 29 de diciembre de 2017 | Noticiero | Telemundo - Duration: 4:33. For more infomation >> Las Noticias de la mañana, Viernes 29 de diciembre de 2017 | Noticiero | Telemundo - Duration: 4:33.

For more infomation >> Las Noticias de la mañana, Viernes 29 de diciembre de 2017 | Noticiero | Telemundo - Duration: 4:33. -------------------------------------------

Casa Real cuando Madrid era sin Letizia la capital mundial de la realeza - Duration: 6:52. For more infomation >> Casa Real cuando Madrid era sin Letizia la capital mundial de la realeza - Duration: 6:52.

For more infomation >> Casa Real cuando Madrid era sin Letizia la capital mundial de la realeza - Duration: 6:52. -------------------------------------------

Emerging threats For more infomation >> Emerging threats

For more infomation >> Emerging threats-------------------------------------------

Letter School handwriting apk alphabet backwards 3X Speed lowercase letters Trace Practices z to a - Duration: 11:55.

Letter School handwriting apk alphabet backwards 3X Speed lowercase letters Trace Practices z to a

-------------------------------------------

Honda Civic | FD2 TypeR Body Kit // Modification (Facelift) # Part1 - Duration: 9:02. For more infomation >> Honda Civic | FD2 TypeR Body Kit // Modification (Facelift) # Part1 - Duration: 9:02.

For more infomation >> Honda Civic | FD2 TypeR Body Kit // Modification (Facelift) # Part1 - Duration: 9:02. -------------------------------------------

Steuererklärung Rentner Muster | Elster Tutorial | Steuererklärung selber machen - Duration: 21:33. For more infomation >> Steuererklärung Rentner Muster | Elster Tutorial | Steuererklärung selber machen - Duration: 21:33.

For more infomation >> Steuererklärung Rentner Muster | Elster Tutorial | Steuererklärung selber machen - Duration: 21:33. -------------------------------------------

How to Earn Kohl's Cash For more infomation >> How to Earn Kohl's Cash

For more infomation >> How to Earn Kohl's Cash-------------------------------------------

Visit Memphis! (but don't stay in the ghetto) | EZ Daze RV Park Review - Duration: 12:22.

all right so basically I have been here for a short period of time in Memphis

and I thinking about I am I am leaving and I feel I feel bad about it

so as I said I am going to have to leave early

sadly the worst part about is I did tell a couple people that I was gonna meet up

with them and I been so busy and I just I'm terrible with plans like I am

absolutely horrible with plans I'm always working so just to give you guys

a heads up my favorite things are work being alone hanging out with people in

that order those are my three top favorite things

and you know work and being alone and it's like usually takes priority but

since it is going to be like my last day here I'm gonna probably be leaving

tomorrow I wanted to finish up with a review of easy days RV park

this is a dog run this is where the dogs do their running it's quite open this is

where I can only imagine the humans do their sitting while the dogs do their

running it's nice that they have a little lounging area for humans

even got this great security gate that I've never seen down it makes you feel a

little safer though doesn't it yeah and it's got a propane fill in the back of

the office it's got these nifty vending machines they are $1.00 ice and even

bathrooms

pretty nice they've got everything you would expect from a bathroom we've got

toilets they've got sinks and over here they

even have showers 1 2 3 showers all with little doors on them

and right on the other side of the bathrooms it's the pool the pool is

closed right now because it's freezing cold but there is also see that that is

a hot tub and that is still open if you want a tub but then you have to leave

the hot tub and I'm assuming the walk from the hot tub back to your fifth

wheel or RV or whatever is probably pretty miserable so that is this side of

the park there's also another side across the street now I'm really dark

but here's the sidewalk and that's where I am over there I'm gonna take the truck

though cuz I drove over here mostly because see how this packages that's why

I drove over here but nobody got it for me I got him for myself actually my dad

paid for a lot of the winter clothes it was super nice of him that's my winter

or my Christmas gift thanks dad all right here we are on the other side of

the park now go into the little shared bathrooms and

showers and get this this place has a workout room as well

those have to wait and see

beautiful overhangs can't see me can you see me now there are restrooms there's a

conference room over here

conference room with vending machine directly next door can't get much better

than that and then if we go over here you have to skateboard or no if you

can't skateboard you'll fall come on there we go go over here on the

other side you see what that says massage therapist no I'm not aware if

that's like available now or when that is available but apparently is available

sometimes which is pretty cool and then my favorite room and if you've seen this

one before the exercise room and if we go ahead and beautiful automatic lights

there is a pull-up thingy with like a dip thing like the AB thing I'm the only

one that uses room so everything set up for me down here there is an elliptical

a bike and a yoga mat with eight and ten pound dumbbells not a whole lot of

weight but enough to do like a high reputation workout and plus there's a TV

in here if you like watching TV it's all about YouTube now just watch more of my

videos alright back out to the bathrooms and

here we are in the bathroom with shower with beautiful pressure and

hot water ample pressure ample hot water never ran out of either just excellent

wraps these will hang any code any code unless

your coat is made of bricks probably wouldn't hang your brick have this

accelerator dryer here for accelerated drying this wonderful full-size mirror

to see your full-sized body and then sink it's always cleaning here just

always spot on I think they have a cleaning lady to come out here like

every single day so you have no excuse for the bathroom whatsoever love these

bathrooms and it's heated in here so even though it's 20 degrees outside

it's like 60 in here so I mean seven you probably 75 feels

great

I believe that leaves us with just one other thing

and that's prices so just to give you an idea all of these spaces are concrete

they're all even concrete pads they all have picnic tables they all have full

hookups 30 and 50 amp service that's every single place in the entire park

they all have water and sewer and not only that that electricity and tax are

included in all of these prices which is a gym I love when not only electricity

but also taxes are all included so you know exactly what you're gonna pay from

the prices that they display that's just such a big deal to me because like why

are you not gonna include a 13 percent tax florida come on re eleven and a half

or whatever it is anyway so it did their daily right here that's for one day at a

time is $49 all included and they also have a ten percent discount for military

seniors triple-a like all these different things so that takes down to

44 all right their weekly rate here is three hundred

dollars so I think that's for all spaces whether it be a pull-through or a back

end same goes for the daily rate I think it is whatever they have available at

the time they'll put you in a pull-through if they can

and then the final rate is the monthly rate and for the monthly rate there is a

difference between the back end and the pull through the pull through is five

hundred and seventy seven dollars per month and the back end is five hundred

fifty dollars per month just to give you give you an idea of how big these spaces

are this pull through is well over fifty feet my truck my trailer both fit and

then I kind of a couple feet extra so I would say probably about 55 foot spaces

the back ends are pretty long too I would probably say closer to 40 though

so if you have a bigger rig there's absolutely no issue here there's been

some people with long class A's towing trailers that have both fit in just one

space oh yes and I almost forgot to mention the Wi-Fi at this part the Wi-Fi

out this park is good it's not amazing it's not the fastest it's not as fast as

I would like it to be I can't upload videos in five minutes but for the

average person who's doing average things on the Internet if you were

trying to watch Netflix or if you're streaming videos on YouTube its it can

do all of that I'm not sure if it would get worse when the park is more full but

it's relatively full right now and I'm not having too many issues it's a little

slower than I would like probably one of the better parks that I've been to

definitely one of the better parks that I've been to thus far and that's such a

big deal of me it allows me to work online it also allows me to do things

like watch YouTube videos or just do simple things on the internet without

having to sit there and stare at my loading page for eighteen years which I

loved so all in all how would I rate this RV park I gotta say it has

everything I would ever want I give it a four and a half it has all of the basics

it doesn't do anything crazy above and beyond but it has all of the basics it's

got a pool it's got a hot tub so those are extras and it's got electricity

included to me like that's what makes a really good park a five would be

something that's just ridiculous it's just above and beyond it would be like

if the Galveston Park I stayed at linked right there had all of the basics if

they had all the basics they would have been a five but instead therefore if you

have all the basics for a half four and a half stars for this

part guys if you're coming to Memphis I highly recommend EZ Daze RV park this

would probably be it probably is the only option if you don't want to be in

the middle of the ghetto that's that's the truth and you still want full

hookups and a relatively cheap monthly price this is basically the only option

so if you want to come here you have to stay here if you enjoyed this video guys

make sure you subscribe to the channel I do RV park reviews every single time I'm

at an RV park and if I'm not at an RV park

I don't do RV park reviews but I put out videos daily regardless so make sure you

like this video subscribe to the channel comment down below if you have any

questions or if you want me to cover anything or if you want me to go

somewhere whatever the case may be and until next time guys I will see you

later

-------------------------------------------

Buồn Của Anh - K-ICM, Đạt G, Masew ► GDM-T [Cover ] - Duration: 4:43. For more infomation >> Buồn Của Anh - K-ICM, Đạt G, Masew ► GDM-T [Cover ] - Duration: 4:43.

For more infomation >> Buồn Của Anh - K-ICM, Đạt G, Masew ► GDM-T [Cover ] - Duration: 4:43. -------------------------------------------

Older FTM UPDATE 6 months T video Xmas - Duration: 14:15.

Hi guys it's Jett here and this is my Merry Christmas video. I hope you're all

having a great Christmas so far and you're gonna have a Happy New Year.

I haven't made a video for a while there's a few reasons but mainly because

I had sort of a sabbatical with my testosterone- I mean I was still taking

it but I was a bit flatlining on my levels- well quite the opposite actually... when I

was taking the packets of Testogel religiously every day but not at the

same time every day which may have hampered the readings I apparently kept

coming back with very high T levels so some people say that it converts it back

into estrogen- I'm not sure what happens there but I wasn't having many changes

anyway and I was up in the air and well I can just make excuses all day but why

would I do that when here I am... I will tell you what I have been up to though

which is Nebido. I have been switched over to what I don't know if

you can get everywhere in the world or I'm pretty sure you can't but and it's

it's more the the long-acting shot that you get every say three months but it

does vary if your levels are too high or too low they can vary it I have heard as

infrequent as 16 weeks and as frequent as 8 weeks depending on where your

levels are but sorry to jump in and say Happy Christmas and get straight on to T

levels but you know that's where I am that's the level I'm on- not literally

the level but that's the level I'm at is talking about blood results and

testosterone levels and this is where we come in because I haven't as I said made

a video for a while so I just thought, Can't leave you guys alone at Christmas geez I gotta like make an

update and just sort of say hi guys happy Christmas and hope you've not missed me

too much yeah it's a little

disheartening when you know your levels aren't optimum and you see people who've

been on T for the same amount of time as you and they've got little hairs growing

everywhere well I am I mean I don't know if you can see it but I've got a darker

bit of fuzz around my upper lip and I'm starting to get like the odd like bits

of bum fluff on my face.. I mean it's nothing really to report home to and to

be honest I've seen little old ladies with more than what I've got but this is not

disheartening in any way because my voice has definitely dropped so I have

noticed that change I mean I have had my first Nebido shot which is the long

acting in the loading phase so that was five weeks ago so just after Christmas I'm

due to get another shot and I will tell you this it's the most painful shot I've

ever had in my life- okay well not really but yeah it was a bit tender however

saying that afterwards you totally forget the pain and you never have to

think about it again until your next shot is due and this is where I like

about it is where I was doing the testo gel packets every single day I had to

potentially wake up do the same routine every single day at the same

time and it just it wasn't working for me because I'm just not that routine I'm

not that routine of a guy and as much as I tried because obviously it

means a lot to me you know to be able to get the levels that I want

but I just couldn't practically do it so I mean what works for one guy is

not going to work for another so you know everybody takes their T however they can

get it and for me the packets were painless easy and I'd

highly recommend them if you can take them but I just had trouble maintaining

consistency - I'm really not that consistent so yeah that's that's where I

faltered but um yeah I'm liking this Nebido. I hate the pain

I mean it's not that painful no I'll tell you what it didn't hurt to ask for

the shot. They did a very good job at my GPs because

the shot has to be administered well it doesn't have to be they I've seen or

heard them do them all the wrong ways but the best the optimal way and the

way that's recommended by the drug provider itself is to take the shot Oh

up to two minutes it should take to administer and it should be warm you

know I mean I brought my wife along and she's got hot hands so she heated it up

for me so that was nice my doctor she was good as gold

she she elongated the shot up to two minutes so it took that long to deliver

you know so it wasn't a painful whack she did --everybody did everything

right and it was just a tiny bit of sting once you take it out and I'm just

over dramatizing how much it stung... it isn't that Pleasant

but you know literally what's five minutes of your life if you don't

have to do it every day you know okay when I say five minutes I couldn't sit

down after I had to go yeah I had to I had to try and sit down on one side of

my butt cheek cuz it was a bit tender I took my wife for tapas - hummus and olives.. but I just

couldn't sit down properly only for a very short 45 minutes - an hour- there's

just a bit tender and then the next day it was a bit you know but what I mean

I'm not gonna go on about the pain because that makes me sound

like more of a wuss than I actually am because I can take it it's just yeah just never

mind and so let's move right along and not concentrate on that- the best thing is is that I am noticing

changes on that and I'm not sure if it's because I've switched to taking the

long-acting Nebido shots or because it's at time that I would start noticing

changes anyway which is supposed to be around the five six month mark anyway so

it's really hard to tell which is which but I have noticed I mean I am starting

to grow furry thighs furry belly coz like who doesn't want a furry belly?

voice lowering you know a bit of stubble it's still fluffy

I mean everybody has different growths at different times different stages and

you know varies one guy to the next but um I suppose in some ways I'm not

expecting as much as some guys because I'm an older trans guy which does I

really think make a difference because the older you are everything

slows down not just you know your changes but everything you know I cut

myself like three months later, oh dear how's that going?... so your body starts to slow down

and it's like production of things and you know naturally I'm I'm at that time

when to be honest I should be having more changes than I actually am

which which is also kind of bizarre because I'm still experiencing I'd say

I'm experiencing more female and the Shark Week is like just as much as it

was before and if not worse I gotta get my levels checked again you know these

things that you know you just have to weigh them up and see how it goes for

you but you know we're playing it by ear and watching and waiting and seeing what

happens so all good so far- I mean I'm still

happy I knows things are happening I know things are I'm just waiting for my

second signature sorry I didn't mean to do that to you but-- it's my dog you can

probably not hear... he's also a senior like me he's not going through same changes

it's just barky um yeah so some of the things some of the things--- nope he

doesn't need me-- so some of the things that I'm waiting to have are: second

signature at the GIC which I shall get for my top surgery which I'm really

looking forward to well sort of looking forward to-I'm really looking forward to getting rid of...

and I'm considering what to do downstairs

but that is another thing for the New Year's consultation so there's lots to come. I'm sorry

that I haven't made the comparison videos for the top binders compression

vests or the STPs or Packers because because I am waiting

I know that under the Christmas tree I am- sorry- I blame him he did it

naughty elf. I'm expecting to get an STP in my stocking from Transthetics. I

know I shouldn't know these things but I do um so I didn't want to make a

comparison video until I have that one because it would be wrong to leave it

out and as well and again I'm expecting a binder to come after Christmas from

the urban out-- the Spectrum Outfitters- sorry Urban Outfitters is something completely different

spectrum outfitters they're sending me a binder that I would

like to include in the comparison so those will both happen in the new year

because I'd like to be more comprehensive so that is basically

what's been happening I mean and this like you have any questions I don't

think I have anything else to say about my transition I'm going to try and keep

you more informed in the new year about what's happening with me and I'll see

how that goes I have noticed that things but you know I mean just minor things

that you know -we can talk, we can talk -it'll be good... you know like mental things

and cravings and just normal things that like

I'd say any guy would go through if they're going through puberty like oh

and all the other things that they wouldn't expect to have to go through -

like being considered a different gender while you're doing puberty it's it's

very difficult in some ways you know I mean I use the men's now like 100% of

the time and I'm not read 100% of the time as male but when I go into the

loo nobody bothers me at all but as soon as I come out of the loo and I go

and use a kiosk or something and ask for a drink they go there you go

madam right yeah yeah thanks you know so you know it's fifty of one and six dozen

of another you know there we go so anyway sorry if this has been long

but you know I'm catching up so for me I'm the naughty elf it's a

happy Christmas and a merry new year enjoy yourselves guys and catch you up

I've been jet subscribe if you want to see whatever happens next I know I do

later dudes

-------------------------------------------

[Eng Sub] Typical Rejection ARMY gets in daily life when no one in your family is into K-POP (BTS) - Duration: 1:21.

Me: Hana, turn KBS on. Hana: Why?

Me: I want to watch Song Festival. (I want to watch BTS) Hana: I don't want to!

Yup, as always, when your family isn't into K-pop, they just don't cooperate!

It's 8:30pm, and KBS song festival 2017 is starting soon, and I need to watch BTS!!

Click on KBS 2

There's commercial!

Yay~ It's starting!!!

Our boys will slay again!

Getting ready to watch BTS and make subtitles for I-ARMY!!

Let's enjoy and appreciate our precious boys!!

-------------------------------------------

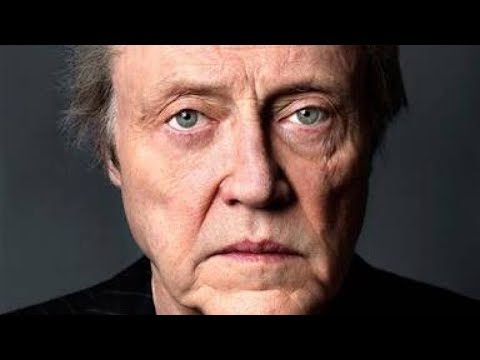

The Untold Truth Of Christopher Walken - Duration: 5:09.

Everyone has their favorite Christopher Walken moments, whether it's the monologue from Pulp

Fiction, the devastating end of The Deer Hunter, or that epic video for Fatboy Slim's "Weapon

of Choice."

He's such a distinctive character in his own right, it's almost as if he's made a career

out of playing himself.

But is he?

Here's the untold truth of Christopher Walken.

"I tell you this, because as an artist, I think you'll understand."

Performer or actor?

You know how actors like Daniel Day-Lewis immerse themselves in a role, staying in character

even offscreen for as long as the movie takes to make?

Christopher Walken is exactly the opposite.

When it comes to preparing for a role, all Walken does is memorize his lines, his least

favorite part of the job.

His approach to acting is simple: he says,

"No matter what character I'm playing, it's me.

I'm the only person in my life that I can refer to."

Just a little something to keep in mind the next time you see him onscreen playing a sadistic

avenging angel or a resurrected horseman from hell.

He's unambitious

Guardian reporter Emma Brockes once described Walken as so aggressively modest it made him

seemingly immune to criticism — and she was definitely onto something.

Walken isn't self-important; if someone doesn't want him for a part, the actor doesn't get

offended.

And if he goes for a while without working, he doesn't panic; actually, he embraces it.

"If I'm not working I don't leave the house."

Ultimately, Walken credits his long career in showbusiness — and his lack of an ulcer

— to not trying too hard.

He describes himself as "lazy," and when it comes to his work ethic, he says,

"I don't chase stuff."

His secret identity

Even Walken super-fans might be surprised by these little-known facts: For one, he's

the star of the best tap-dancing striptease ever caught on camera.

And for two, Walken's real name isn't actually Christopher!

It's Ronald, after old-school British actor Ronald Colman.

Christopher, on the other hand, is the name randomly bestowed upon him by Belgian star

Monique Van Vooren when he was working as a backup dancer in her cabaret.

"She'd try out different names on me. One night he said, I'm gonna call you Christopher.

And I said, fine.

Just don't call me late for lunch."

Walken liked "Christopher" enough to keep using it professionally.

His friends and family, however, still call him Ronnie.

A Hollywood tragedy

In 1981, actress Natalie Wood drowned while sailing off the California coast — and Christopher

Walken found himself unexpectedly tangled up in one of the most sensational and mysterious

accidents in Hollywood history.

Walken and Wood had been filming a movie together at the time, and he was on the yacht that

night along with her husband, Robert Wagner, enjoying what some witnesses described as

quite a rowdy party.

The devastating accident is a tragedy Walken has been trying to put behind him ever since;

in 1986, he responded to a reporter's questions about Wood by saying that it was, quite simply,

"a conversation I won't have."

He really talks like that

"Wow!"

"Wow."

Wow, indeed.

Ask anyone to do an impression of Christopher Walken, and they'll imitate the actor's well-known

habit of arbitrarily emphasizing random words and pausing in odd places — but that's not

just an on-screen affectation.

It's actually how he talks.

Walken attributes his unusual speaking style to growing up in a Queens neighborhood where

English was everyone's second language, saying,

"It's a rhythm thing - people who speak English where they have to hesitate and think of the

right word.

And I think it rubbed off."

Walken also changes his scripts to suit his speech patterns, removing punctuation and

swapping periods for question marks.

But despite being one of the most mimicked actors in Hollywood, he still doesn't recognize

his voice when it's coming out of someone else's mouth — so don't bother trying to

wow him with your Christopher Walken impression.

"When people do that I never know what they're doing"

Stolen wardrobe

In 2010, Walken showed up to an interview with The Independent sporting a jacket he'd

worn on screen twenty years earlier in The Comfort of Strangers — and when someone

asked about it, he freely admitted that not only did he lift the jacket from the set,

but it wasn't a one-time thing.

He said,

"I never buy clothes.

Whenever I do a movie, all my clothing is from that movie set.

They don't give me anything.

I steal."

Apparently, Walken's reputation for petty theft preceded him on at least one movie set:

When he was in Batman Returns, the clothing department cleared out his dressing room while

he was filming his last scene — which means he didn't get to take home a single statement

bow tie from his turn as the evil-yet-dapper Max Schreck.

Unusual fears

Despite playing many characters who would be right at home in your nightmares, Walken

has plenty of fears of his own: including driving, flying, airports in general, and...

horses?!

Yep, it's true: as far as Christopher Walken is concerned, the scariest thing in this horrifying

scene from Sleepy Hollow isn't the headless rider, but the horse — which was actually

a mechanical animal augmented with CGI in the few scenes where Walken had to appear

on horseback.

He hates parts written just for him

If nothing confuses Christopher Walken more than a Christopher Walken impression, then

nothing annoys him more than seeing one in a script.

In an interview with Rolling Stone, the actor admitted that he hates when writers revise

a script with him in mind, a process he calls Walkenizing.

As a result, the actor turns down a lot of roles that he feels are deliberately weird

— although that still leaves plenty of room for wholesome, organic weirdness like this.

"Did you ever take a picture of your nose?"

Thanks for watching!

Click the Grunge icon to subscribe to our YouTube channel.

Plus check out all this cool stuff we know you'll love, too!

-------------------------------------------

Free Thoughts, Ep. 219: How the Federal Reserve Works (with George Selgin) - Duration: 58:12.

Trevor Burrus: Welcome to Free Thoughts, I'm Trevor Burrus.

Tom Clougherty: And I'm Tom Clougherty.

Trevor Burrus: Joining us today is George Selgin, a Senior Fellow and Director of the

Center for Monetary and Financial Alternatives at the Cato Institute and professor of emeritus

of economics at the University of Georgia.

Welcome back to Free Thoughts, George.

George Selgin: Thanks Trevor, it's nice to be here.

Trevor Burrus: What is the Federal Reserve?

George Selgin: The Federal Reserve is the United States' central bank, and what that

means [00:00:30] is it's the bank responsible for determining what other banks do and the

resources they have available for their activities; the Fed creates the ultimate dollars in the

US monetary system.

Those dollars consist of the Federal Reserve notes everybody sees, and they also consist

of credits that banks can keep at the Fed, can have at the Fed—which is for that reason

called [00:01:00] the banker's bank—and those reserve credits—so called—can be

converted by the banks into paper dollars any time the banks request it.

So using these Federal Reserve dollars as an essential input as it were, the banks go

about their business of creating their own claims to dollars, making loans in dollars,

and creating deposits that are denominated in dollars that people can also spend.

Trevor Burrus: So does the Fed do this ... Does it have the authority over printing [00:01:30]

money and stuff, and does it decide how much money is printed, or does it do it through

some other mechanism?

George Selgin: Essentially the Federal Reserve decides the overall amount of Federal Reserve

dollars, including paper currency, and those credits I mentioned that banks hold at the

Fed.

The Fed determines the sum of those two values, and by doing that determines the scale in

directly of all dollar creation of private dollars like bank [00:02:00] deposit dollars

because of the amount of those ultimately depends on some extent on the availability

of the dollars that the Fed creates.

I should mention because it's common source of confusion that the Fed doesn't actually

print Federal Reserve notes, that's done by the Bureau of Engraving and Printing, but

the Bureau of Engraving and Printing just acts as a service or supplier for the Fed,

but it's the Fed's policies that ultimately that determine [00:02:30] how many of these

notes get put into circulation.

Tom Clougherty: Now, George, you haven't mentioned interest rates yet.

I think if you asked most people what does the Fed do?

What is monetary policy?

Well they'd say the central bank sets interest rates.

I don't think that's quite right, but if it's not, where the interests rates come into this

story?

Trevor Burrus: That's the one thing people know.

Tom Clougherty: Interest rates, yes.

George Selgin: Yes, well it's the one thing people know, but it is really starting as

it were in the middle instead of the basics.

The basics [00:03:00] really do have to do with the Fed's creation of dollars.

The reason interest rates come into the story is because the way the Fed regulates the extent

to which is creates the basic dollars, or the available supply of basic dollars, or

regulates the purchasing power of those dollars, one or the other depending on the regime is

through interest rates that it manipulates or controls.

[00:03:30] So for example, the Federal Reserve before the crisis would have set a policy

rate, and it would ... That would be the rate in which banks could borrow Federal Reserve

credits from one another overnight.

So as I mentioned before, some of the basic Fed dollars that are created consist of credits

that banks have deposits at banks, keep at the Fed dollar [00:04:00] denominated, of

course.

In the old system, things have changed in a way I hope we'll get around to talking about.

In the old system, if banks were short of these deposit credits for their reserve requirements

or other reasons, they could borrow.

One of their choices was to borrow from other banks that had more than they needed, and

that rate of interest at which that overnight interbank borrowing of Federal Reserve credits

took place of Federal Reserve [00:04:30] dollars was called ... Is called the Federal Funds

Rate.

That rate for years was the policy target rate, and the Fed would say well, we think

a good place for the Federal Funds Rate to be is, let's say three percent.

If it crept up above that level, that would indicate that reserves were a little bit in

short supply and it would create some more dollars, put some more dollars into the economy,

make reserves, [00:05:00] Fed dollars more abundant to bring it, the rate, back down

to the target of three percent.

So superficially, monetary policy was about setting the Federal Funds Rate target.

It was about in ... Not just interest rates but specifically this one interest rate.

But underlying this process or goal of keeping this interest rate on target was the basics

of [00:05:30] supply and demand for Federal Reserve dollars for the dollars that the Federal

Reserve alone was capable of actually creating or removing from the system if necessary.

Trevor Burrus: Are you ... You mentioned it's the bank of the United States, now if you

study American History and you learn about the battles over the first bank of the United

States, and the second bank of the United States, is the Fed the third bank of the United

States?

Is it in the same vein as that, or I guess I'm also asking where ... [00:06:00] When

did they come about, where did it come from in that kind of line of progression?

George Selgin: Well yes, according to most authorities, the Federal Reserve was ... Is

in effect the third bank of the United States, in that the first two federally chartered

banks, the first bank of the United States and it's successor, the second bank ... They

were at least proto-central banks.

They had lot ... Some things in common with a modern central bank like the Fed.

They weren't quite [00:06:30] full fledge central banks in many respects, but they certainly

were ... Had some features of modern central banks.

That's why there was a great to-do about the establishment of the Fed because the previous

federal banks had been quite controversial, and the second federal bank's charter had

been famously not renewed by Andrew Jackson who employed his veto power to [00:07:00]

veto to the bill to recharter the second bank, and it looked like at that point we were ... The

United States was done with this idea of a federally chartered bank, or proto-central

bank, or whatever you want to call it.

It took some pretty clever political maneuvering and several financial crises to get central

... To get us back to having a central bank to having the Fed, which was established in

1914.

It's [00:07:30] a long story about the politics, and the instability that informed our taking

up again this idea of having a central bank, and it's a story I've written about.

But in any event, it took a lot of people by surprise to find back in 1914 that we had

not after all settled the question of whether we should have a central bank or not, for

once in for all.

We thought [00:08:00] we had, everybody thought so, particularly the Democrats who were the

party who got rid the second bank of the United States, but low and behold they were also

the party that decided to pass the Federal Reserve Act.

Trevor Burrus: That period of time, roughly 80 years of no central bank, was that ... Was

there some huge gap, or was there some institution that did the job, or was that job not really

needed to be done?

George Selgin: [00:08:30] Well first of all, in principle the job doesn't need to be done.

Particularly if you have a specie or gold or silver standard, which was the case back

in the 19th century and early 20th century.

When you have such a standard, first of all you have a basic money that doesn't inherently

have to be supplied by a public authority today.

Where our standard is paper money itself, [00:09:00] of course it's not something that's

naturally scarce, so only a public utility as it where could be relied upon to supply

the stuff and with luck supply so little of it that it doesn't become worthless.

But when you have a specie standard, in principle, you have a monetary standard that doesn't

absolutely require a central bank.

Now the question is can you have also a stable safe monetary and banking system without a

central bank and the answer [00:09:30] is yes, you can.

Canada here, offers a particularly good illustration because until 1935, Canada didn't have a central

bank, but it had the same basic gold unit, gold dollar that the United States had.

Had a decentralized system, multiple banks, commercial banks issued the paper money of

Canada that was convertible into a dollar ... A fixed amounts of gold, and it was a

very stable well working system.

So Canada's case [00:10:00] is certainly suggests that you didn't need to have a central bank.

'Course the United States didn't have that same system.

When we got rid of the second bank of the United States, what emerged from that step

was not a Canadian type system, but a system that was a real motley arrangement with numerous

states, first of all, [00:10:30] that had their own banking and currency systems all

of which were quite different, and involving different degrees of government intervention

and regulation.

That was the situation until the outbreak of the Civil War.

In those systems, some of them performed relatively well, particularly the ones in the Northeast,

and some of the Southern systems, but others were quite ... Performed quite poorly.

One [00:11:00] of the things though that was common generally with the exception of a few

southern states was that banks could have no branch offices.

That meant that there were no ... There was no paper money that was nationally recognized

or uniform in value.

A bank's notes could be well received and accepted at their face value locally, and

maybe for some distance from their source, but if they traveled far away enough to other

states, [00:11:30] then at some point they would not be trusted or known enough to command

their full value.

So we didn't have a uniform paper currency.

The only thing that was uniform was the gold coin itself, if you took it ... Or silver

if you took it to other parts of the country was still worth what it said it was worth.

So Canada's system was quite different in that regard.

They allowed their note issuing banks to branch nationwide and most of them took advantage

of that, and by the 1880s, '90s, you had [00:12:00] a system of bank notes with different brands

of notes, but they ... You could take a note from Halifax to Vancouver, still would be

worth it's face value.

So the Canadian system achieved a uniform paper currency, a uniform in a sense of uniform

value by allowing banks to be more free, whereas in the U.S. our motley system of state bank

regulations prevented any such result from happening, [00:12:30] that's before the Civil

War.

Trevor Burrus: Do you need a ... Am I hearing correctly that it's better argued that you

would need one of these if you have a fiat currency of some sort, but when we started

it, we were still on the gold standard from what I understand.

George Selgin: Yes, my point is that if you have a fiat currency, since the fiat money

only ... Doesn't have a natural scarcity, so if it's gonna command value, it's quantity

has to be artificially restricted, [00:13:00] and that has to be a matter of policy.

It isn't obviously something that you can rely on profit maximizing issuers to do because

they might just want to issue a whole bunch at once, and get what they can.

So in practice, if you have an irredeemable money, you need some kind of public authority

that you hope, you entrust the responsibility of limiting the quantity of the stuff of supplying

it, but supplying it only in sufficiently limited extent.

[00:13:30] That's why fiat money systems require some kind of central authority, usually a

central bank.

It doesn't follow though that central banks have only been created in ... For the purpose

of controlling fiat money.

Central banking predates fiat money as you noticed with the case of the Fed.

'Course the earliest central banks go much further back, the motivation for creating

central banks in fiat, [00:14:00] in ... Sorry, in metallic money systems are quite different.

The further back you go, the more obvious it is that the motivations were fiscal.

Basically these public authorities could ... Had a flexibility that allowed them to contribute

to the financing of their sponsoring government and make life easy for them, especially during

wars through generous accommodation, in return for the monopoly privileges that they enjoy.

This was the story with the Bank [00:14:30] of England, Bank of France.

Then later on, you had the development of the view that central banks could contribute

to the stability of gold standards by serving as lenders of last resorts, to the commercial

banks and by being a source of emergency loans to them.

This view particularly solidified after the famous ... After the publication of Walter

Bagehot's famous book, Lombard Street, [00:15:00] which is the bible of last resort lending-

Trevor Burrus: When was that?

George Selgin: It was 1873, however it should be said, and many people don't realize this,

that when Bagehot wrote Lombard Street, he was referring of course to the Bank of England,

and the role it should play in reverting or limiting crises.

He was very explicit in that book.

He said that the ultimate course of instability in the English banking system was the Bank

of England's monopoly [00:15:30] privileges in the way they resulted in a concentration

of reserves in that bank, such that it became the only agency capable ... It was both the

instrument by which instability was generated, and the one institution that could act to

contain the damage from that instability if it would only act in a public spirited way

by lending generous once a crisis broke out.

But Bagehot was quite emphatic that if you hadn't had this monopoly ... [00:16:00] This

heaping up of monopoly privileges in the Bank of England, if you had what he called a natural

banking system with reserves and privileges spread out among competing banks.

An example, contemporary example would've been the Scottish system, then you won't need

a lender of last resort because you won't have the underlying cause of instability in

the first place.

Unfortunately most people have read ... Most economists have read Bagehot [00:16:30] as

making a positive case for central banks as lenders of last resort in a gold standard

context.

But of course, in the fiat money context, therefore you have two rationales for having

a central bank.

One is to control the ultimate quantity of money, which it otherwise is not self controlling

and the other is to have a source of emergency funds when the ... When things go array in

the banking system, and that's what we ... That's the conventional wisdom today.

Tom Clougherty: [00:17:00] Yeah, so we had the Fed now for 100 years or more, and it's

clearly changed an awful lot over that period of time.

What monetary policy means in practice has really developed beyond all recognition.

I think we should probably bring this conversation a little bit more up to the present day, in

particular the financial crisis of 2008.

I know for me, and I think for a lot of people, that was when we really got interested in

monetary policy.

When people thought maybe there's something weird going on here, and we should learn more

about it.

[00:17:30] So maybe before we just jump into that though, let's talk about what was the

status quo before the financial crisis in terms of monetary policy.

Now you've already said the Fed would manipulate the Federal Funds Rate, they'd affect the

cost of banks lending or borrowing from one another.

Why were they doing that?

If they raised interest ... That interest rate or lowered it, what were they trying

to do and what was its knock on effect in the economy?

George Selgin: As you said Tom, the Fed's [00:18:00] responsibilities and power changed

dramatically since 1914, and to by the period before the crisis for some decades ... Of

course, the gold standard was no longer part of the story, so the Fed had absolute responsibility

for the overall amount of money created in the economy, and therefore for controlling

the rate of inflation and deflation.

The Fed's mandate [00:18:30] required it to ... Both to avoid dramatic instability of

the value of money ... And substantial changes in that value, and also to limit unemployment,

so the Fed had it as it were secular mandate, longer run mandate to make sure that the dollar

didn't depreciate too rapidly relative to goods and in a more cyclical mandate to make

sure that we didn't have cycles of unemployment-

Trevor Burrus: How did-

George Selgin: Which could partly be a reflection [00:19:00] of a short run shortage of money.

Trevor Burrus: Okay, that was my question ... 'Cause I, yeah, it seemed like something

that's not related to monetary policy.

George Selgin: No it is.

Too much money, you get inflation, too little money, you get deflation.

Too little money in the short run, you can get a downturn, a business downturn with unemployment

until either the central bank makes up for the monetary shortage or prices adjust downward

and end up on the newer equilibrium, but that's a process fraught with difficulties.

Tom Clougherty: Actually George, when we say there isn't [00:19:30] enough money, then

in the short run that could cause a downturn, what does that practically mean, not enough

money in the system?

It's not like people can't find the bank notes.

George Selgin: What it means is that people ... In practice, what it means is that there

may be plenty of money out there, but the money isn't being spent.

So people hold on to money balances to a certain degree, but ultimately the main reason people

hold [00:20:00] on to money, which consists of a Federal Reserve cash or certain kinds

of bank deposits is to have a ready access to purchasing power for spending.

Things go sour in monetarily speaking, either when the rate of spending is excessive, so

there's too much money chasing after too few goods in the famous formulation of Milton

Freedman, or when the opposite happens when spending declines rapidly.

The reason these are both [00:20:30] problems is because you want ... Businesses have to

re-coop their expenses on average, some businesses may not, and others may profit, but on average

we don't want them all losing money because that just means ... That doesn't prove that

the businesses are bad, or that we should be putting resources elsewhere.

It just proves that spending is not keeping up with underlying cost.

Spending is shrinking, so avoiding a shrinkage [00:21:00] in the flow of spending is important

as a way of limiting business cycles, and unemployment, and deflation.

On the other hand, if everybody is ... If people are spending more than ever, profits

are swollen, that doesn't give you a useful signal about which businesses ... You can't

have more of everything.

You can't have more investment in everything.

So what ends up happening, of course, is costs start rising, the profits disappear, costs

can't [00:21:30] keep up with prices.

In equilibrium, there's an equilibrium that's the same as where you started, but the process

of adjustment can involve some ways.

So this is where we get this idea that a good central bank will manage things so that prices

neither rise rapidly, nor fall rapidly, and cycles are avoided.

But at bottom, it's really about stabilizing, not prices per se, but spending.

Keeping 'em spending on a nice even [00:22:00] schedule.

Trevor Burrus: This is what ... This is like before, so ... 'Cause from what I understand-

George Selgin: This is still true.

Trevor Burrus: This is still true, but from what I understand with the ... So this is

what they were doing before the Great Depression, in the '50s, it was ... They were all ... They

were still just mostly focusing on the ... What you said, the inflation rate and the unemployment?

George Selgin: What I've just described it what they ought to do, and it still what they

ought to do.

It is never been exactly what they have done because they screw up all the time.

You've had episodes of sever deflation [00:22:30] like the '30s, you've had long periods of

mounting inflation like the '70s and early '80s, '60s, late '60s, and of course, we had

the recent crisis, so what I was describing was an ideal, what they ought to try to do,

rather than what the Fed or any other central bank has actually been doing.

The ideal hasn't changed, the ideal was before 2008, it's still the ideal today.

Now, the question then is [00:23:00] how did they try to do the right thing?

Whether they did it or not, and before 2008, to go back to that discussion of interest

rates and all that, they used ... What they would do is they would set up policy rate

target.

Now basically what this means is that they would say to themselves, "Well we believe

that if banks are borrowing from each other at a three percent rate, that's going to be

consistent [00:23:30] with an overall level of money creation, loan lending, etc., that

we'll achieve our spending, stable spending target."

Okay?

Implicitly, that won't ... Or that won't cost too much inflation or deflation, it won't

cost too much on unemployment.

So the target rate is a rate that is ... There ... It's what they believe is the rate that's

consistent with achieving [00:24:00] their overarching objectives.

They might be wrong in their choice of this target rate, but let's assume that they actually

are correct.

That they know where that rate should be to keep things going smoothly.

Then of course, they ... Their objective, their immediate challenge is to see to it

that the actual rate at which banks are borrowing from each other doesn't deviate from that

target.

The way they would do that in the old pre-2008 days, was if the [00:24:30] rate ... If the

actual Federal Funds Rate tended to be rising above the target, let's say above three percent,

they would go out and purchase assets in marketplace, usually government securities, and they would

pay for them with newly created deposit credits, Federal Reserve credits, and that would mean

the bank reserve become more plentiful, and that would mean the supply of Federal Funds,

right?

Which is the reserves available for overnight lending would go up, and that should [00:25:00]

lower the actual equilibrium funds, right?

And help get the target-

Trevor Burrus: Lower the interest rate on borrowing and so-

George Selgin: That's right.

Trevor Burrus: But theoretically encourage more house, buying of houses, and car loans-

George Selgin: The idea is if the Federal Funds Rate is getting too high, that will

also will tend to mean tightness and other lending markets, so in keeping it from rising,

you're also keeping those other rates from rising.

Conversely, if the Fed [00:25:30] Funds Rate is sagging, that suggests that there's not

much demand for Federal Funds.

You want to keep it at target, you're gonna withdraw some reserves 'cause evidently there's

more out there than banks need to sustain the target interbank rate.

That's how the system works, so it's a combination of setting a target interest rate that you

hoped was the right target, and then engaging in what are called open market operations,

which is either buying government securities [00:26:00] in the open market and having the

Fed buy these securities, or selling them, depending on whether they wanted to make reserves

more available or less to achieve the target.

If doing all this, they then found that ops, the inflation rate is higher than we thought

it would be, or lower, or unemployment is not where we think it should be, that would

of course be caused for rethinking the target they've been setting, adjusting it upward

or downward, and then [00:26:30] undertaking corresponding open market operations to achieve

the new and hopefully correct rate target.

Tom Clougherty: So hopefully correct.

George Selgin: Yeah.

Tom Clougherty: But did this process go completely haywire in the run up to the financial crisis?

If so, what kind of role did it play?

George Selgin: I wouldn't say that the process when haywire in the run up to the financial

crisis.

The financial crisis of course is a situation where you can have [00:27:00] an often typically

do have an extraordinary demand for reserves, right?

Because of panic, because of uncertainty, because of perceived risks of lending, so

suddenly other things equal the tendency is for banks to clamp down on lending, including

interbank lending, and for the demand to hold reserves to become extraordinarily high under

those circumstances.

For a given Federal Funds Rate target, the challenge [00:27:30] of monetary policy becomes

to supply that many more reserves to keep the target at the rate, at that target because

otherwise it's certainly gonna tend to rise above.

So in a way, there's nothing different from a crisis situation, it's business as usual,

except that it's a situation where in order to keep its target, a central bank has to

create a lot more reserves than it normally would ever have to do, that is then [00:28:00]

it would have to do on crisis time.

Until 2008, sometime in the middle of 2008, the Fed was, I think, more or less doing that.

For example, the first big shock of the crisis, big financial shock that mattered from a monetary

policy point of view was when the Bank Paribas in France [00:28:30] looked like it was about

to go under, and in response to this big liquidity shock, sure enough-

Trevor Burrus: With that ... I want look at that term, liquidity shock.

They just can't enough money right at that moment?

George Selgin: There's an exceptional demand to pile up a bank reserves finance ... By

different financial institutions, banks and other financial institutions want to stock

up on cash.

That is precisely the circumstance [00:29:00] that means that they're ... That they were

less willing to lend cash, which means interbank rates are gonna go up unless somebody else

makes more cash available, which is where the central banks went in.

That's just what the Fed did in that episode, you could look at the statistics and see the

amount of Federal Reserve dollars spikes 'cause they're pouring more in to make up for the

reality that there's an exceptional demand, and that is still ultimately aimed at keeping

[00:29:30] the target rate where it's supposed to be.

Now of course, in the background you have the ongoing consideration of whether the target

rate itself needs to be adjusted in light of these developments because it may also

turn out that you need to set that rate lower in order to accommodate the changing reality

that involves a greater ... Once again a much greater demand for Federal Reserves and liquidity,

so [00:30:00] the two things are happening.

One, it takes more reserves in a crisis to keep the target where it is, and also a crisis

is a time when your target rate might need to be lower ... Lowered as in recognition

of the exceptional persistent demand for liquidity.

As I said, until 2008 at least, I think the Fed's conduct was about right in light of

these basic principles, [00:30:30] but then in 2008, things started to go quite haywire,

and did so I think not just because the crisis becoming that much more sever, which it did,

but because I think the Fed made some very serious miscalculations that actually in turn

contributed to the severity of the crisis.

Trevor Burrus: Well some of those, I heard some people argue that some of those included

low interest rates after 9-11, like too low of interest rates [00:31:00] helped move us

towards the crisis because people were borrowing too much.

George Selgin: Well now you're stepping back-

Trevor Burrus: Yeah, a little bit, but-

George Selgin: There is a question whether the Fed set its targets too low, not so much

after 9-11, but after the dotcom crash, whether it kept rates too low for too long, set its

target too low, and then of course, acted to achieve that target.

No, I think there's a lot of truth to that.

That is setting too low a target [00:31:30] in turn contributed to do an excess creation

of reserves, excess credit, excess lending, which contributed to the sub prime, what we

know in retrospect was a sub prime bubble.

I think that's all true.

The mistakes I'm talking about are ones the Fed committed after the bubble breaks, which

I believe it started to make some real mistakes in that case, some time in mid 2008.

Trevor Burrus: So [00:32:00] what are those?

Are they related to just bad interest rate setting, or is it-

George Selgin: Ultimately-

Trevor Burrus: A new thing entirely?

George Selgin: Ultimately they are ... Ultimately they are to put it as tersely as possible.

Starting in around mid-2008, the Fed became determined to stick to what in retrospect

was too tight of monetary policy stance to maintain a target interest rate [00:32:30]

that was too high relative to what was really required to help the economy stay on its feet,

or avoid a collapse.

For some time, they set the target rate at two percent, which sounds very low and was

low by historical standards and more typical norm would be four percent, twice that.

However, in crisis situation, it can take a much lower target interest rate to avoid

a downward spiral, and I think [00:33:00] in retrospect, it's pretty clear that the

two percent rate that the Fed was striving to maintain was too high.

It only very reluctantly lowered that rate, first to 1.5% after the Lehman disaster and

then eventually as low as two point ... .25% or a range from zero to 2.5, but by that time

it was too late, and indeed, even 2.5 was too high.

But [00:33:30] it's interesting to look back at why the Fed was obstinate or ... Again,

this is all hindsight, right?

So we mustn't be too ungenerous when all this is going on, it's very hard to tell exactly

what the situation is.

But what seems to be the case was at the time, the inflation numbers did not seem to suggest

that the monetary policy was too tight and there were [00:34:00] genuine fears that it

might in fact be too loose, so you had people pressing for the maintenance of two percent,

arguing against lowering it, the so called inflation hawks were doing their thing, and

it was to satisfy that ... Those concerns that the consensus ended up favoring, trying

to maintain first two, and then 1.5%.

Even though if you look at what was happening [00:34:30] at the time, whatever regardless

of the inflation numbers, actual spending was collapsing, and inflation numbers can

be very misleading because they indicate a number of things, most obviously they don't

just depend on how much people are spending.

They depend on this state of availability of various goods, and services, and commodities.

So spending is really what you want to look at, and if you looked at spending, it was

going down the ... Going down [00:35:00] very rapidly, but it's how the Fed strove to maintain

two percent despite what was going on that I think was particularly tragic because in

fact, the Fed was creating reserves or would have creating reserves during this period.

These are the months leading up to Lehman Brothers, including the time of its collapse.

The Fed was engaged in substantial emergency lending to various banks through various lending

[00:35:30] programs, banks and some other financial institutions and markets.

If the Fed had simply done that, it would have ... And not tried to compensate by other

means, we would've had a substantial increase in reserves, analogous to the increase from

the Bank Paribas crisis hit, that should have helped to maintain liquidity, keep lending

and spending [00:36:00] from collapsing.

However, because it was determined to maintain at two percent rate target, the Fed feared

that these lending programs would create too many reserves, and it offset them until Lehman's

failure, or after offset them 100% with open market sales, which of course, are normally

a tightening measure.

So it took back with one hand what it put in with the other.

Total liquidity didn't increase at all, therefore for these crucial months when spending was

[00:36:30] actually collapsing, you could see that the Fed's balance sheet doesn't grow

at all.

It's flat because there's more lending, but there's open market operations that's the

Feds selling treasuries from its portfolio to offset the loans that are otherwise increasing

the total assets.

There's no net liquidity creation in this crisis.

It's much worse than Bank Paribas, you would think.

Let's put a lot of liquidity [00:37:00] out there 'cause things are really gettin' scary,

and that's not what the Feds doing.

It is actually depriving the more solvent financial institutions in the marketplace

of funds in order to move a greater supply of funds to troubled institutions that are

taking part of ... In its emergency lending programs.

Trevor Burrus: That's interesting 'cause it makes me wonder about why it makes these choices.

Is it politically influenced?

[00:37:30] Is there something going on ... It's supposed to not be, even though the president

chooses the Fed Chairman, does it seem like their playing politics to some degree?

George Selgin: Well it's ... There's no question that there's a lot of pressure on the Fed

to aid particular financial institutions, especially the large ones, the too big to

fail ones, that it's gonna give them credit no matter what because it's ... It fears that

if they fail, the dominoes will start falling.

[00:38:00] The problem is that ... Be that as it may, whether those decisions are sound

or not, it doesn't make any sense if you're concerned about other dominoes falling, so

you wanna prop up the one domino in front of the line that you're most concerned about.

You can't do that by taking credit away from all of the other dominoes in order to prop

up the first domino because then you're causing them to suffer liquidity [00:38:30] shortage,

so they may not be in trouble because the big domino falls on them, they're in trouble

because you're taking liquidity away from [crosstalk 00:38:40]-

Trevor Burrus: All the back dominoes are falling, even though the front ones are standing up.

George Selgin: And if we go back to Bagehot, of course, if we go back to Bagehot, this

is entirely contrary to the spirit of Bagehot.

For Bagehot, the reason you need a lender of last resort is not to prop up the trouble

institutions, it's to see to it that the sound institutions stay sound.

They don't [00:39:00] suffer collateral damage from other failures, and it's perfectly possible

in principle for the Federal Reserve to lend generous in a crisis to sound institutions

without deprive ... Instead of lending to the unsound by depriving the sound of liquidity.

A second best solution would be create a lot of net liquidity, bailout some big firms,

but make sure you keep the other firms that are sound [00:39:30] from suffering as a result

of your policies.

The Fed chose to do the worst possible thing.

It propped up the insolvent or presumably insolvent institutions by lending generously

to them, but it was also sucking back liquidity from the rest of the marketplace, which causes

the crisis to spread that way.

If your goal is to keep the crisis from spreading, you're not gonna do it by punishing the solvent

firms [00:40:00] to prop up the insolvent ones.

Tom Clougherty: So that ... The Fed's started to go wrong in the middle of 2008.

George Selgin: That's right.

Tom Clougherty: They weren't increasing general liquidity.